Missing WaMu / FDIC Receiver Deeds = No Conveyance Of Title To JPMorgan Chase

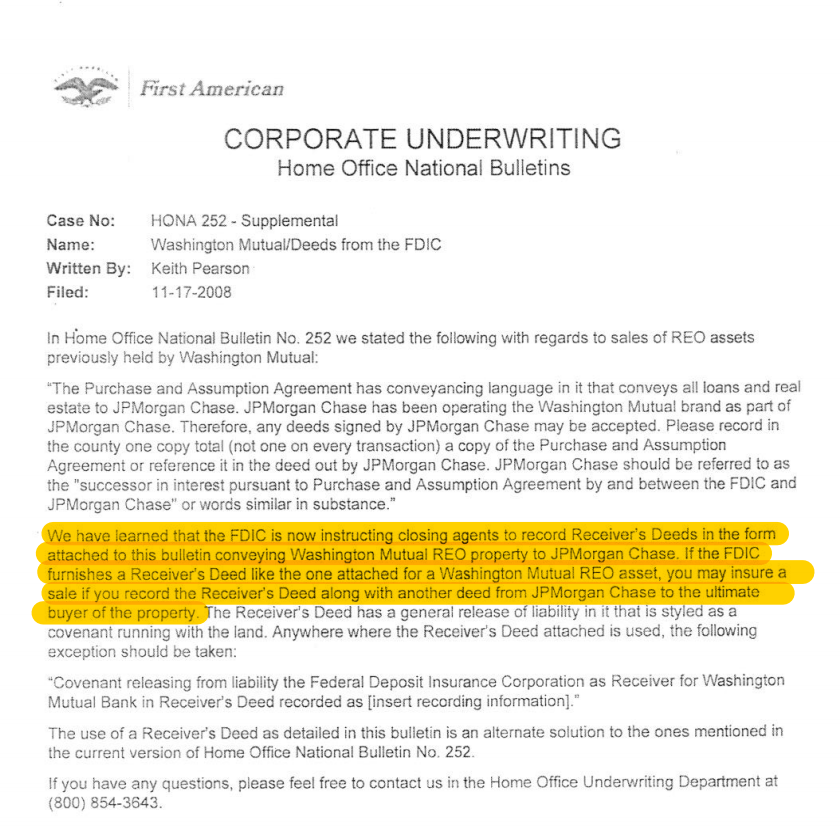

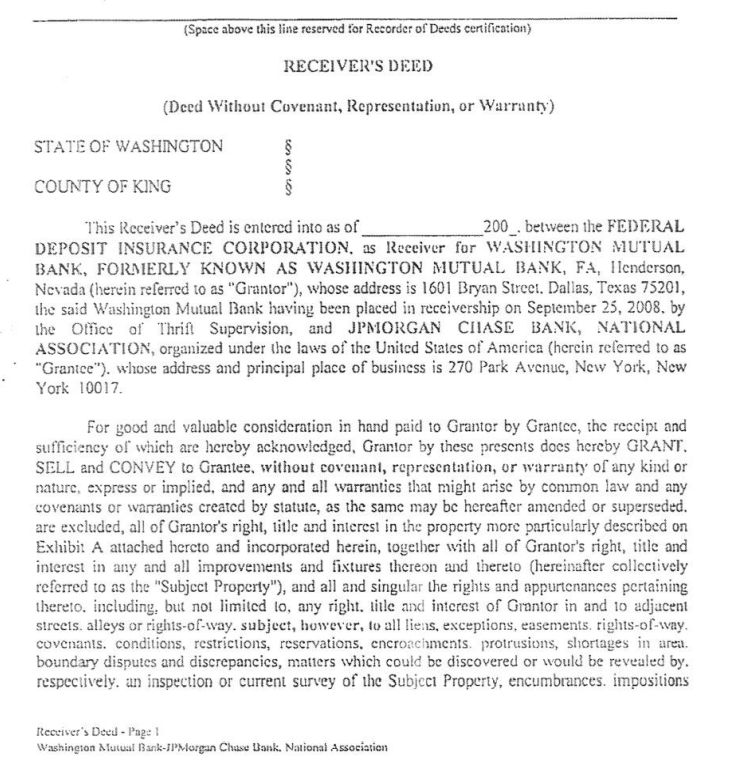

In November of 2008, a national bulletin went out to the title companies informing the underwriters that the FDIC was putting them on notice of the need to record “Receiver’s Deeds” with the sale of foreclosed WaMu loans. Here is one such bulleting to First American Title (See: 1st American Bulletin WAMU – Nov 2008 – FDIC Recording of Receiver Deed).

The FDIC’s instructions align with the very specific “Limited Power of Attorney” granted for these “REO” properties as follows:

The LPOA can be found here: (FDIC Power of Attorney Documents Produced on Subpoena)

The LPOA can be found here: (FDIC Power of Attorney Documents Produced on Subpoena)

In my decade of investigating the foreclosures of WaMu loans by JPMorgan Chase, I have yet to see a recorded Receiver’s Deed transferring and conveying title from the FDIC to Chase. These missing Receiver’s Deeds reveal the broken and “clouded” chains of title on virtually all WaMu foreclosed homes post FDIC Receivership on 9/25/2008, and that JPMorgan Chase had no title to pass in the sale of these REO properties.

Bill Paatalo

Private Investigator – Oregon PSID# 49411

bill.bpia@gmail.com

Leave a Reply