JPMorgan Chase Ordered To Produce Wire Transfers Of Borrower’s Payments To Trust

Things are going to get real interesting now! On February 15th, 2018, the following Order was handed down in the Circuit Court for Palm Beach County, Florida. Here is a little background on this case.

The Plaintiff is current on his loan that was originated in 2005 by Washington Mutual Bank, F.A., and has never been declared in “default.” However, having become aware that serious defects may exist over the title to his property, Plaintiff sought answers to the most basic questions. Who owns my loan? And, who is receiving my payments?

As most readers can guess, the answers to these questions have been met with great resistance and animosity by Chase’s counsel. This begs the question, why would JPMorgan Chase, as the alleged servicer for the Plaintiff’s loan that is not delinquent, fight tooth and nail over having to disclose this information? I believe we may have the answer to this question within the next 9-days. This is because the Court, upon a Motion to Compel evidence, has just Ordered JPMorgan Chase to produce to Plaintiff, “(1) wire transfer history for Plaintiff’s account reflecting payments made to JPMorgan Chase Bank, N.A. and forwarded to Wells Fargo or any other entity via wire transfer; and (2) servicing agreements between Chase and Wells Fargo authorizing Chase to service the loan and enforce the note and mortgage.” (See: Proodian V Chase Order)

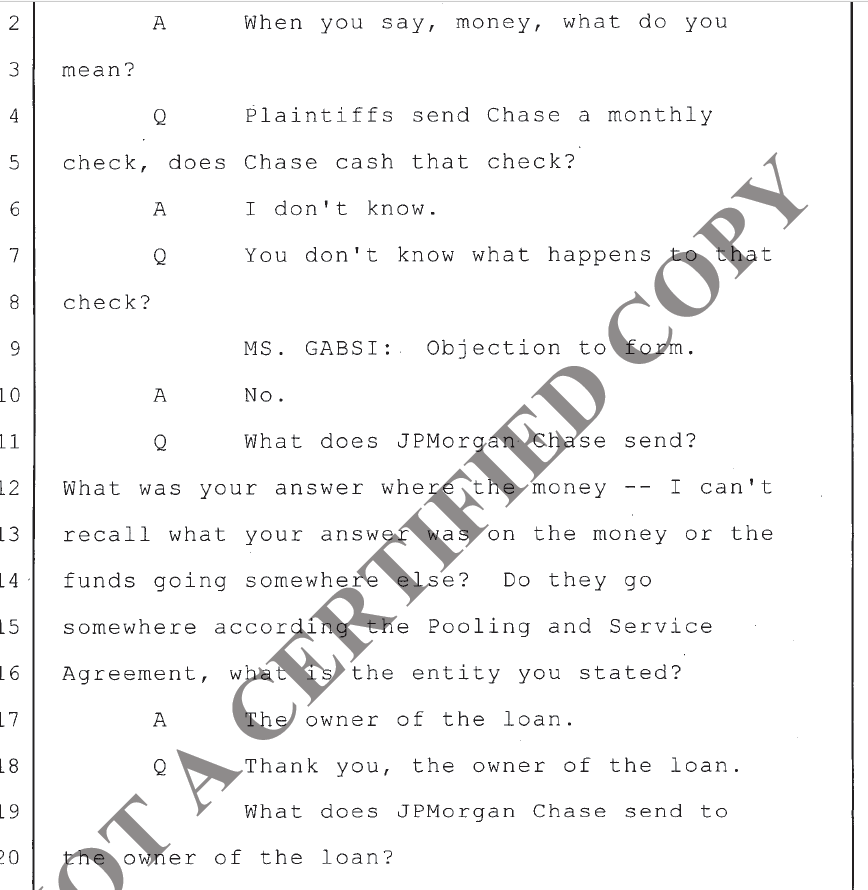

Here’s the testimony of two Chase witnesses who were deposed prior to this Order. First, we have Chase in-house counsel Matthew Dudas:

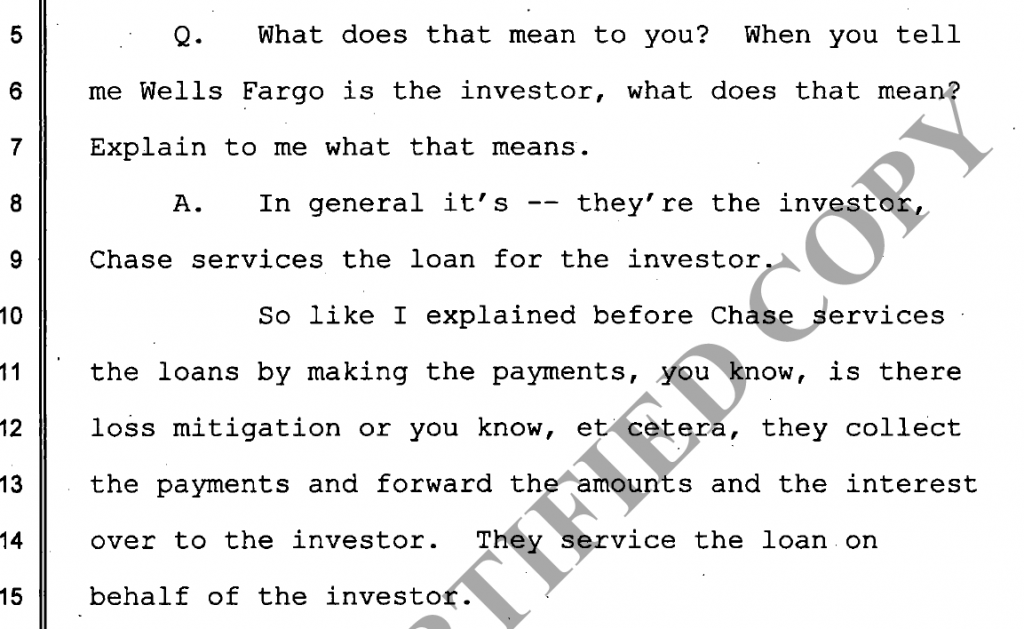

Then there’s the testimony of Peter Katsikas:

I believe the rationale behind this Order stems from the fact this is a non-default situation. Chase’s attorneys are struggling to defend this action because they cannot rely upon the worn-out “deadbeat trying to score a free house” argument. I’ve been saying for years now that the banks may have dominated the narrative in the foreclosure realm thus far, but they are going to be in big trouble if/when the masses of borrowers, who are “current” on their mortgages, begin their own crusade for answers as to who owns their loan, AND WHERE ARE THEIR PAYMENTS GOING? Until these questions are properly answered through verified evidence, no one’s title and money is safe.

Things are going to get very interesting now!

Bill Paatalo

Private Investigator – OR PSID# 49411

BP Investigative Agency, LLC

bill.bpia@gmail.com

Bill,

Great going , another one of many ‘huge “discoveries you have made. This new discovery will propel all of our cases.

The great work you did for me, is starting to pay off.

The strategically conceived, highly articulated argument contained in the affidavit submitted in my case against Chase, was really compelling.

Now the several breakthrough confirmations.

Thank you,..Sir !

all the best,

bf