Hearsay Is Not Hard To Prove In Foreclosure Land

The money trail does not lie. But the documentary trail lies all the time. | Livinglies’s Weblog

“It is not a business record unless it is a record of the business conducted by the company that is the source of the report. (No exceptions).

If it is not a business record then it is hearsay. Hearsay is not admissible evidence.”

Everything Neil states in his blog post above is entirely correct and can be corroborated if you know how to aggressively attack in discovery. The courts have known and understood this problem since the very beginning:

HONORABLE BRUCE PRIDDY: It’s just — to me, I think we need to massage it a little bit and not encourage folks who do this, because it really kind of devalues the idea of personal knowledge in my court because of what they’re saying they have personal knowledge to they can’t possibly have personal knowledge to.

BAGGETT: That’s probably right.

MR. BARRETT: So finding a document that says, “I am the owner and holder, and I hereby grant to the servicer the right to foreclose in my name” is an impossibility in 90 percent of the cases.

MEETING OF THE TASK FORCE ON JUDICIAL FORECLOSURE RULES – November 7, 2007 – Austin, Texas

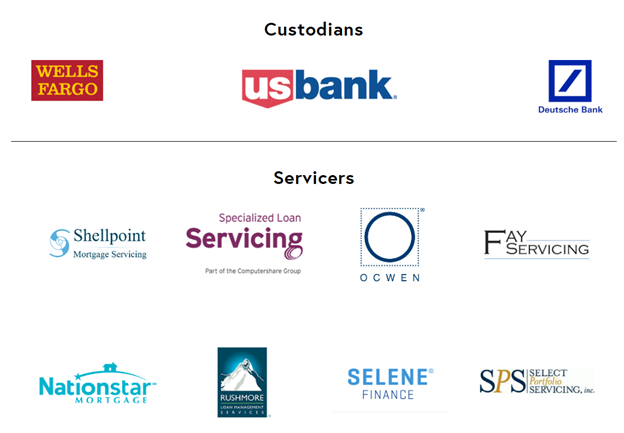

Behind every so-called “servicer” is a myriad of vendors providing all the behind scene services to which the Robo-witnesses have no personal knowledge of anything. The “On-Boarding” processes attested to in nearly all cases is a complete sham. For example, here is an advertised “Vendor Network” associated with a company called “Street Solutions, Inc.” The network utilizes over a dozen “Diligence Providers” (DP’s) to which the major “servicers” outsource darn near everything. These DP’s will “crack your loan tapes,” “administer your systems and facilitate reporting,” and “rigorously scrub, format, prep, and standardize unruly data.” Everything is controlled and maintained by these vendors to which the fake “servicer” entities have direct access to the data for a fee. Data can be accessed by numerous parties all at the same time, and can be changed and altered routinely as needed. This eliminates the need for expensive infrastructure, of course. Here are some of the snippets I’ve extracted that demonstrate everything Neil and I have been pointing out.

Vendor Network — Street Solutions, Inc.

Services – Promontory MortgagePath

Regulatory Compliance Testing – Covius

Assignments of Mortgage – Nationwide Title Clearing

Loan Sale / Transfer

Assignments are generally required in a whole loan sale, servicing rights sale or securitization. NTC’s services include setup and management of the process with full preparation and execution/notarization of required documents, mailing, recording, tracking and imaging documents upon return with robust status and progress reporting. As a standard part of our mortgage assignment services, NTC is poised to accommodate all agency, MERS and county requirements. NTC can work with any volume and offers fast turn times without sacrificing accuracy.

Default Assignment Process

NTC will review loans going into default for any remediation needed prior to referring a loan for foreclosure or during bankruptcy. NTC manages the process according to investor rules and foreclosing entity requirements. Assignments are prepared and recorded, as applicable, with a package of the documentation supporting that the loan is appropriately in the name of the foreclosing entity, enabling the client to move to the next step in the process.

NTC also provides a complete chain of title binder service that incorporates a note review to determine the note holder, remediate it to the foreclosing entity, if necessary, and then includes a validation in the package delivered.

One Source for Servicing Solutions

Optimize your mortgage servicing operations from loan boarding through lien release: reduce operating expense, enhance borrower experience, boost retention rates and drive digital transformation.

SitusAMC | Real Estate Finance & Mortgage Solutions Provider

Complete loan accounting system combining cashiering, data entry, accounting, and investor reporting functions into one platform.

SBO.NET® validates that each sub-servicer is servicing your loans correctly including payment applications, arm adjustments, and loan modifications, while verifying remittance amounts are correct based on underlying loan activity and servicing agreements.

SBO.NET automates all accounting functions including generation of loan level journal entries, daily accruals and reserves, sub-ledger for balance sheet accounts, comprehensive interest analysis module, and amortization of purchase premiums / discounts and MSRs. The system validates and reconciles daily and monthly servicer cash collections and remittances, helping find money that otherwise would be lost. Additionally, the system maintains, controls and stores accurate data for analysis and down-stream reporting. SBO has wide industry adoption with over 100 sub-servicers’ data being consumed and reconciled in the system.

Independent, defensible valuation, analytics and hedging services.

SitusAMC is a leader in the valuation, analytics and hedging of MSR, whole loans, and other hard-to-value assets. Our team of dedicated analysts marry key market and industry data, our own unparalleled time-series and point-in-time loan performance information analysis, as well as trade data from our brokerage team. We focus on data quality, applying technology to rigorously scrub, format, prep, and standardize unruly data, which results in better performance models and metrics and a deeper understanding of its asset-level characteristics, behavior, and performance, monitoring and referencing it over the life of that asset.

Doc Management | Due Diligence | Domestic BPO | Services EdgeMACEdgemac

Our Due Diligence solutions are designed to help clients manage risk and identify opportunities associated with residential and commercial mortgages. A robust data-centric model provides clients with a more accurate and reliable understanding of the quality and value of the underlying assets.

Our Document Management and business process outsourcing lets clients leverage our expertise, personnel, equipment and systems to capture and organize information and streamline internal processes.

Bill Paatalo

Private Investigator – OR PSID# 49411

bill.bpia@gmail.com

Leave a Reply