For Banks, Its Just Business. For Arnoldo Ortiz, Its A Prison Sentence.

I came upon the following story out of Texas last fall while investigating a forged deed used to steal my own property.

The story of Arnoldo Ortiz angers me to the core. Not because he was charged with the crimes and sentenced to prison, but because the largest banks and servicers, through their minions of document mills and law firms, have been committing the exact same crimes for years while law enforcement continues its pattern of “standing down” against the big financial institutions.

“The scam has become so troublesome that a “Deed Fraud Task Force” of federal and local law enforcement is being formed to “hit back fast and hard,” Dallas County Assistant District Attorney Phillip Clark told WFAA.

“A person’s home is their castle and their American dream,” Clark said. “It’s shocking that someone would try to steal that away with nothing but a fake signature.” Does anyone find this as insulting as I do?

“WFAA has found that when property records are filed with the county clerk, no one checks to see if it’s legitimate.”

“For now, the system relies mainly on notaries verifying identifies. But as WFAA found, there are gaping holes in that process. To perpetrate a fraud, all a scam artist needs to do is find a willing notary, be a notary themselves, or create a fake notary, WFAA found.”

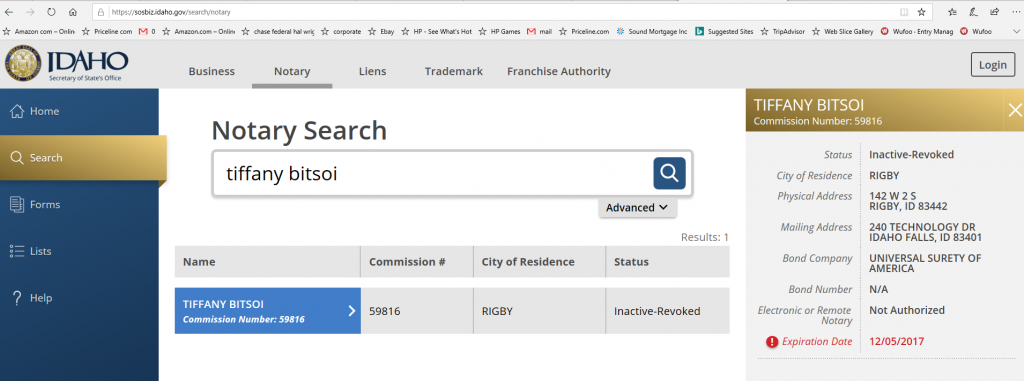

I concur. “Tiffany Bitsoi” is a name you will find on hundreds, if not thousands, of fabricated title documents coming from “Security Connections” in Idaho which is now known as “First American Mortgage Solutions.” First American touts the following on its website:

CleanFile Solutions® Perfected Collateral. Complete Confidence.®

In 2017, Bitsoi was caught by the State of Idaho for having fraudulently procured a notary commission using fake documents, including a phony bond.

(See: BITSOI Suspension letter_Redacted )

Bitsoi has worked for Security Connections and First American dating as far back as 2013. What did the State of Idaho do? They revoked her fake notary commission. I’m still confused as to how a fake “commission” that never existed gets revoked?

Anyhow, Bitsoi appears to have faced no criminal prosecution for her fraud; a fraud that undoubtedly has assisted in the corruption of thousands of title records, not to mention the foreclosures and theft of the related properties. Her employer has not been required to mitigate the massive fraud by cleaning up the toxic mess left in its wake. Rather, the clients who utilized their services get to keep their fruits produced by this poisonous tree.

Then we have the notorious Nationwide Title Clearing in Florida who touts this on its website:

A client of mine was sued judicially by Wilmington as Trustee for the SASC 2003-35 Trust. When this trust was exposed for all kinds of defects, deficiencies, and fraudulent behaviors, Nationstar Mortgage was substituted in its place and later obtained the foreclosure judgment in its name. Shortly after, my client agreed to tender the full amount of the judgment (roughly $1.3M) to keep his home. When my client sought information as to where he was to wire the funds, a new trust appeared in place of Nationstar. This of course sent up a red flag.

My client was told to just pay the money and quit asking questions. Despite the pressure, my client dug in his heels and demanded two things as a condition to tendering his $1.3m. First, he wanted to see an assignment to this new trust from Nationstar, and second, he wanted his “original” note marked “paid / cancelled” (in red-ink) returned via U.S. Mail in a sealed envelope upon receipt of his funds. These requests would normally be deemed reasonable. The opposition agreed to the assignment, but not to the return of the original note. The court then issued an Order with the following:

- Within thirty (30) days of Debtor’s satisfaction of all sums due to U.S. Bank, U.S. Bank shall furnish Debtor with the original Note duly endorsed with a red stamp “Paid”/ “Paid In Full”/ “Cancelled”/ “Satisfied”, or similar language, to reflect that the original Note is being returned due to payment having been received in full and mailed by USPS Certified Mail to the Debtor at her residenc[e,]

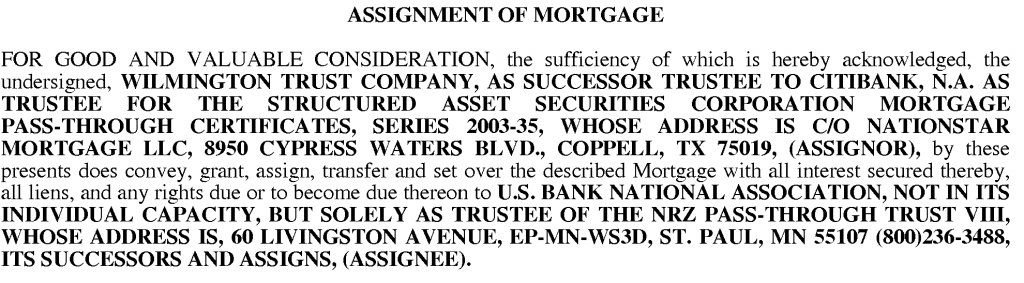

Persistence paid off. As for the assignment, the opposition reached out to their “fixer” Nationwide Title Clearing who obliged with the fake assignment that shows the following assignor and assignee:

As is typical, the assignment fails to assign and transfer the note / debt, which arguably proves that the “NRZ Pass-Through Trust VIII” seeking to collect could not return a note marked “paid / Cancelled” if/when paid in full. But more importantly, the document is executed by “Jackelynn Medero” as “Vice President – Nationstar Mortgage” and notarized by “Karin Chadias” in Pinellas County, FL.

My client hired a fellow private investigator who confirmed that both parties work for NTC, and that Medero was not in fact the VP of Nationstar. This evidence of fraud was put before the judge who ordered a hearing for this past Tuesday and ordered that both Medero and Chadias be individually noticed.

On Monday, the day before the hearing, a new law firm and trust suddenly appeared out of the blue as a claimant on the debt. Both the assignee trust above, and the newest trust to enter the picture, are represented by counsel being paid for by Nationstar Mortgage. I will repeat, Nationstar Mortgage, having been caught red handed for submitting a fraudulent assignment, hired a different law firm using the name of a different trust to defeat its prior claim and cover up the exposure for fraud they now face. Counsel is telling the court it is basically all one big misunderstanding and that they need 30-days to re-record assignments and clean up the title defects before the hearing. So much for their self described “Perfect Docs.”

Per the WFAA article:

“But as quick and easy as it is for someone to commit this kind of crime, it costs victims months or even years of stress and expensive litigation to fix it – both for homeowners and unsuspecting buyers.”

For the banks, document mills, and law firms this is a profitable business model. For individuals like Arnoldo Ortiz, there is a “Deed Fraud Task Force” ready to “hit back fast and hard.”

Bill Paatalo

Private Investigator – OR PSID# 49411

Bill.bpia@gmail.com

Leave a Reply